Another Ofgem price increase. What is going on?

This week, Ofgem announced that the energy price cap will increase by 2% from 1 October 2025, raising annual bills for a typical UK household from £1,720 to £1,755. Notably, the popular press has highlighted that this latest rise is largely driven by higher standing charges—the fixed costs we all pay simply to have the facility of receiving gas and electricity. For Direct Debit users, these standing charges will rise from an average of £296 a year to £320 a year. This reflects around £2.93 extra per month, regardless of actual energy use, making the fixed portion of energy bills a growing financial burden for millions of households. However, this misses the big picture – that we are all paying a huge cost for Net Zero policies and that these sums are only set to increase continuing the relentless attack of our manufacturing ability and general prosperity.

The estimates of the total cost of Net Zero to date range from £10 – £20 Billion per year with maybe a total spend of over £200 billion to date. These are huge sums that the mainstream press are ignoring as the data and discussions relating to power generation and grid build out are complex. They should not as these sums are huge. We have the chancellor desperately looking for £20 billion or so for her budget. She could solve the black hole with one stroke of her pen and rewriting Net Zero and the current crippling energy policy.The Mounting Cost of Net Zero: A UK Reality Check

As the UK persists with its Net Zero ambitions, mounting evidence highlights the financial stress the policy is imposing—especially on the cost of electricity. While political presenters often attribute price hikes to global gas markets, analysis from Net Zero Watch and the latest Watt-Logic report show this narrative is incomplete and potentially misleading.

Net Zero and the Rise in UK Electricity Costs

According to the Watt-Logic report launched in May 2025, UK industrial electricity prices are now the highest in the developed world, making British manufacturers uncompetitive versus their EU and US peers. Domestic prices are the fourth highest globally, despite the fact that UK gas prices rank only fifteenth—a striking disparity suggesting factors beyond fuel cost are at play.

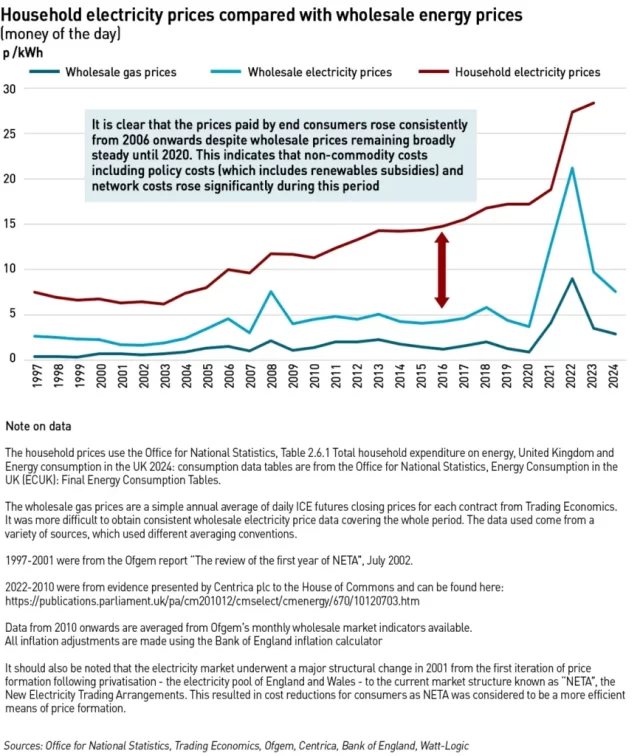

Watt-Logic estimates that Net Zero policies and associated levies will cost UK consumers over £17 billion in 2023-24, rising above £20 billion annually by the end of this decade. These costs are embedded not just through direct subsidies for renewables but also via a slew of additional levies and grid charges required to accommodate intermittent wind and solar. The result? UK households and businesses have collectively paid almost £220 billion more (in today’s money) since 2006 than they would have under a traditional gas-based system—even after factoring in the 2021-2023 gas crisis.

Net Zero Watch further highlights practical failures in policy execution: Large windfarms, including Seagreen, are frequently paid not to export electricity to the grid due to transmission constraints, forcing double costs on consumers—once for the wind, once for gas backup. The lack of joined-up infrastructure planning means constraint costs in 2024-25 hit £2.3 billion, with future curtailment costs projected even higher.[6][7]

The Gas Price Paradox

Despite persistent claims that high international gas prices set UK electricity costs, Watt-Logic’s data shows the divergence between retail electricity and gas prices has persisted since 2006, well before recent market surges. For most of the past 25 years, retail electricity price increases have far outpaced those of gas, driven by policy choices designed to accelerate renewables and grid investment—not by global commodity inflation.

Renewable Subsidies: More, Not Less

A close reading of both sources makes clear: Far from tapering, subsidy costs for renewables are increasing. The Office for Budget Responsibility found environmental levies were £9.9 billion in 2023-24, but Watt-Logic’s bottom-up bill calculation puts the true figure at£17.2 billion when all policies are included. These levies and backup costs continue escalating, with network upgrades, capacity markets, and balancing costs adding substantial “hidden” charges. Failed tender rounds and higher-than-expected strike prices for offshore wind signal that “cheap” renewables remain elusive—and may never materialize on UK bills as promised.[7][8]

Policy Choices and Economic Impacts

Net Zero Watch emphasizes that these escalating costs are policy-driven, not inevitable. Choices to subsidize renewables, construct grid connections for unprofitable windfarms, and impose carbon pricing have outpaced the underlying benefits, undermining competitiveness and driving de-industrialisation. Both reports highlight that had Britain stayed with legacy gas power, consumers would have saved nearly £220 billion.

Will Net Zero Lower Costs in the Future?

Optimistic forecasts by the UK’s Climate Change Committee see possible bill reductions only after 2038—nearly half a century after subsidies began. Watt-Logic’s analysis concludes these projections are unrealistic, based on assumptions for falling costs that are not supported by market evidence, tender outcomes, or supply chain trends.

Conclusion

Net Zero has delivered some emissions savings, but electricity costs for UK families and manufacturers have soared—far outpacing global gas markets and leaving British industry exposed. Policy choices, rather than market fundamentals, drive much of the extra cost. Unless future reforms address the inefficiencies, infrastructure gaps, and costly levies, the UK risks further erosion of competitiveness with little relief in sight for bill payers.

For further reading, see the detailed reports at Net Zero Watch and the Watt-Logic affordability analysis.[2][9][8][1][6][7]

https://www.ofgem.gov.uk/news/changes-energy-price-cap-between-1-october-and-31-december-2025https://www.ofgem.gov.uk/press-release/energy-price-cap-will-rise-2-percent-octoberhttps://www.moneysavingexpert.com/news/2025/08/martin-lewis-energy-price-cap-rise-october/https://www.uswitch.com/gas-electricity/guides/price-cap/https://octopus.energy/energy-price-cap-predictions/https://www.netzerowatch.comhttps://watt-logic.com/2025/05/19/new-report-the-true-affordability-of-net-zero/https://watt-logic.com/2025/05/19/new-report-the-true-affordabhttps://news.sky.com/story/energy-price-cap-government-costs-to-raise-bills-from-october-13418574https://www.ofgem.gov.uk/information-consumers/energy-advice-households/energy-price-cap-explainedhttps://www.bbc.co.uk/news/articles/c78zgz7j576ohttps://www.energy-uk.org.uk/publications/energy-uk-explains-october-2025-price-cap/