iPhone revenue of $85 Billion

Apple reported results last Thursday, 28 January and said:

Today, Apple is proud to report a remarkable, record-breaking quarter, with revenue of $143.8 billion, up 16 percent from a year ago and well above our expectations, said Tim Cook, Apple’s CEO. iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment, and Services also achieved an all-time revenue record, up 14 percent from a year ago. We are also excited to announce that our installed base now has more than 2.5 billion active devices, which is a testament to incredible customer satisfaction for the very best products and services in the world.

During the December quarter, our record business performance and strong margins led to EPS growth of 19 percent, setting a new all-time EPS record, said Kevan Parekh, Apple’s CFO. These exceptionally strong results generated nearly $54 billion in operating cash flow, allowing us to return almost $32 billion to shareholders.

Net sales by category:

iPhone $ 85,269 $ 69,138

Mac 8,386 8,987

iPad 8,595 8,088

Wearables, Home and Accessories 11,493 11,747

Services 30,013 26,340

Total net sales $ 143,756 $ 124,300

Net sales by category:

December 27, 2025

September 27, 2005

iPhone

$ 85,269

$ 69,138

Mac

8,386

8,987

iPad

8,595

8,088

Wearables, Home and Accessories

11,493

11,747

Services

30,013

26,340

Total net sales

$ 143,756

$ 124,300

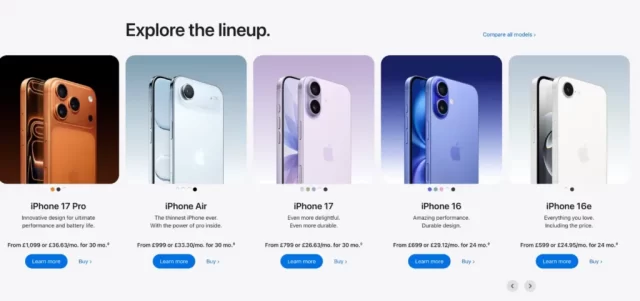

Apple CEO Tim Cook described his company’s recent surge in iPhone sales as “simply staggering” on Thursday. Analysts are exploring several theories to explain the iPhone 17 family’s successful debut.

The company exceeded Wall Street’s expectations in the most recent quarter, generating a total revenue of $143.76 billion. This included a 23% year-on-year increase in sales of its iconic smartphone. Cook praised the quarter, stating it was “fantastic” for the iPhone with an all-time revenue record of $85.3 billion. He highlighted the iPhone lineup as the strongest and most popular ever, noting the extraordinary customer enthusiasm throughout the quarter.

While Apple’s strong results suggest customers aren’t necessarily abandoning their older smartphones for years, a trend facilitated by the tech’s increasing durability, a September report by CIRP reveals a different picture. CIRP, which tracks iPhone buyer data through customer surveys, found that nearly half of U.S. iPhone users now keep their smartphones for three years or longer. This is a significant increase from 24% just five years ago, according to analyst Josh Lowitz, a partner and co-founder at Consumer Intelligence Research Partners.

Lowitz suggests that the increased iPhone revenue at the end of 2025 is likely due to factors such as Apple’s updated pricing strategies and the backlogged demand from customers who last purchased new iPhones during the Covid-19 pandemic.

Lowitz explains that sales were exceptionally strong during the pandemic due to reduced spending on restaurants and travel, resulting in a surge in disposable income. Consequently, the pandemic phone buyers now own 4-plus-year-old phones, which were simply “due” for upgrades. This upgrade surge contributed to the increased demand, he says.

Wedbush analyst Dan Ives agrees, noting that the iPhone 17 upgrade cycle has been surprisingly slow. This is partly because of the “pent-up demand” from an estimated 315 million iPhone users worldwide who hadn’t upgraded their smartphones in over four years, according to Wedbush’s estimates.

Lowitz elaborates on Apple’s pricing strategies, highlighting the company’s decision to streamline its offerings by discontinuing models older than the iPhone 16 line. Shoppers often prefer the middle-ground option when faced with multiple choices, and by limiting options, Apple effectively positioned the standard iPhone 17 as that middle choice.

Furthermore, the iPhone 17 Pro and Pro Max weren’t prohibitively expensive compared to the standard iPhone 17, which discouraged customers from splurging, Lowitz says. Apple’s latest premium-priced Pro and Pro Max smartphones accounted for 52% of U.S. iPhone sales during the most recent quarter, according to CIRP’s estimate.

Lowitz also notes that the phones themselves have received largely positive reviews and are well-regarded by consumers as high-quality technology.

JP Morgan sets $325 as new AAPL target price

JP Morgan said it expected Apple to report $139.8 billion in revenue for fiscal Q1 2026, with the iPhone contributing $80.2 billion, and services totalling $29.9 billion.

This fell in line with the broader market expectation, which pegged total revenue at $138.4 billion, according to Bloomberg.

Out came the Apple’s results, and the company reported $143.7 billion in revenue, with $85.27 from the iPhone, and $30.01 billion from services. In other words, Apple significantly outperformed JP Morgan’s and the broader market’s expectations and so JP Morgan up the APPL target to $325. Apple is currently trading at $262.