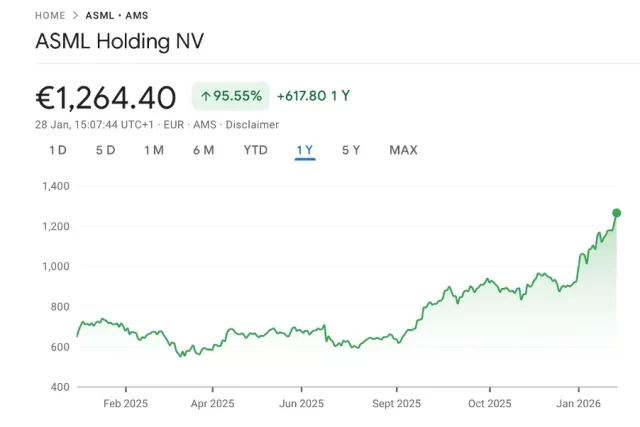

Shares in Chip-Machine Giant ASML soar as AI spending surges.

Europe’s largest listed company reported a rise in earnings, despite planning 1,700 job cuts. Now with a valuation of just under 500B Euro ASML is still tiny compared to the Magnificent 7 who have multi Trillion-dollar valuations.

Even with a 100% growth in the last year the stock has plenty of upside. Europe needs a winner.

ASML’s sales rose to €9.72 billion from €9.26 billion the previous year, surpassing analysts’ forecasts and exceeding the company’s guidance.

Net profit increased to €2.84 billion from €2.69 billion, slightly below market expectations. ASML announced a total dividend of €7.50 per ordinary share for 2025, a 17% increase from the previous year. Additionally, they launched a share-buyback programme of up to €12 billion, to be completed by December 31, 2028.

ASML Holding’s shares are up 4.30% today.

No great surprise that the robust orders for ASML’s machines demonstrate that large clients are investing heavily in tools to produce sophisticated semiconductors to meet demand. ASML’s largest clients include Taiwan Semiconductor Manufacturing Co., Samsung Electronics and Intel.

The company secured orders of 13.16 billion euros, equivalent to $15.85 billion, in the fourth quarter. This figure surpassed analysts’ forecasts and increased from €7.09 billion a year earlier.

Orders for ASML’s extreme ultraviolet lithography systems, high-end machines enabling chip makers to print intricate layers on semiconductors, reached €7.4 billion, significantly exceeding expectations.

This marks ASML’s final quarterly order disclosure. While this metric has long been a key investor indicator, ASML executives argue bookings don’t accurately reflect business momentum due to their quarterly fluctuations. Consequently, ASML will now report its total backlog annually.

Earlier this month, TSMC announced plans for $52 billion to $56 billion in capital expenditure this year, a 27% to 37% increase from the previous year. This record spending boosted ASML’s stock, reaching a market value exceeding $500 billion for the first time.

ASML CEO Christophe Fouquet noted that customers have expressed a more positive outlook on the medium-term market, largely due to increased expectations of sustainable AI demand.

Looking ahead, ASML projects sales between €34 billion and €39 billion for 2026, up from €32.67 billion in 2025. These forecasts indicate a more optimistic outlook compared to a few months ago.

Earlier this July, ahead of a trade deal between the EU and the US, ASML surprised markets by stating it couldn’t guarantee growth in 2026 due to tariff uncertainties. However, in October, executives revised their stance, assuring that 2026 sales wouldn’t fall below the 2025 figure. Despite record orders and growing sales, ASML announced Wednesday plans to reduce its tech and IT workforce by approximately 1,700 jobs, primarily in the Netherlands and some in the US. At the end of 2025, the company employed over 43,000 people.